Financial literacy, a crucial skill in today’s world, is within everyone’s reach thanks to accessible and comprehensible finance books. However, these books are only as transformative as the actions we take upon reading them. The following three finance books are more than just pages filled with advice; they’re your stepping stones to financial understanding. Easy to read and digest, they offer actionable lessons to guide your journey toward financial literacy. Remember, it’s not just about reading—it’s about implementing what you learn.

Table of Contents

The Importance of Finance Books

Financial books are a vital resource for anyone aiming to better manage their money, invest wisely, budget efficiently, and ultimately, attain financial security. But it’s not enough to just read these books—the real value comes when you apply their teachings in your daily life. Let’s not underestimate the significant impact these books can have on our personal wealth and financial stability. Like a secret weapon, they’re packed with expert insights, practical tips, and proven strategies that can lead us to financial success. All you need to do is pick up one, start reading, and most importantly, act on the knowledge acquired.

We’ve curated three exceptional books, each streamlined to demystify financial concepts and promote proactive steps towards financial literacy. These books offer diverse perspectives, with some providing a broad understanding of financial thinking, and others delivering detailed steps towards financial stability. Thus, they serve as comprehensive guides for anyone striving to enhance their financial knowledge and take charge of their financial future.

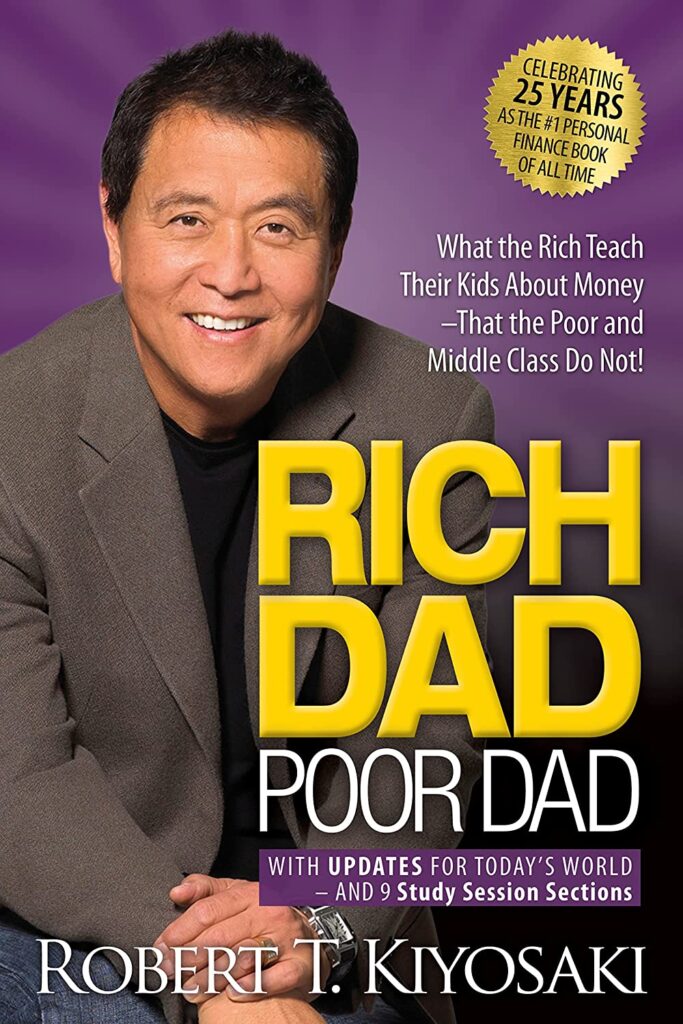

“Rich Dad Poor Dad” by Robert Kiyosaki

Robert Kiyosaki invites us into a world where the perception of money and jobs is viewed through a transformative lens. Kiyosaki shares his personal journey, one marked by the influence of two father figures who held starkly contrasting views on wealth.

One father figure in his life believed in the traditional path to wealth: pursuing formal education and securing a full-time job. This viewpoint reflects a widely accepted societal belief, equating hard work and employment with financial success.

The other, ‘Rich Dad’, challenged this narrative by presenting a different definition of wealth: making your money work for you. He proposed the concept of passive income, where your investments pay you even when you’re not actively working.

One of the most powerful ideas presented in the book is the revised definition of wealth. Kiyosaki argues that real wealth is about financial independence. It’s the ability to stop working altogether and still maintain your standard of living through the returns from your investments.

The book emphasizes a few key lessons. Firstly, it warns against falling into the trap of the ‘rat race’, working in a job you dislike due to the fear of lack of money or the desire for more. Secondly, it advocates for financial education, particularly learning to invest. By understanding how to make your money work for you, you can break free from the traditional paradigm of working for money. Finally, “Rich Dad Poor Dad” challenges you to rethink your attitude towards money, inspiring a fresh perspective that could lead to financial independence.

This post may contain affiliate links, meaning we may earn a commission if you make a purchase through these links, at no extra cost to you. We recommend these products because we genuinely believe they could be beneficial to you. Learn More!

“I Will Teach You To Be Rich” by Ramit Sethi

Ramit Sethi’s book, “I Will Teach You to Be Rich”, serves as a concise, practical guide to navigating personal finance. What sets Sethi’s book apart is its focus on actionable insights and relevant examples drawn from his own financial experiences.

He provides theoretical knowledge and exemplifies each point with personal instances, making the content relatable and easily applicable. One striking example is when Sethi distinguishes between a regular savings account and a high-yield savings account. He explains the difference between these accounts and goes further to disclose the type of high-yield savings account (HYSA) he uses. This allows readers to see how these financial tools can be leveraged in real-life scenarios.

The true value of this book lies in its practicality. Sethi shares tangible advice, offering insights into his own personal choices when it comes to credit cards, savings accounts, and investments. This approach makes his guidance more relatable and trustworthy, bridging the gap between financial theory and practice.

Key lessons from Sethi’s book extend beyond just saving and budgeting. He encourages living a fulfilled life while still being financially savvy. He doesn’t advocate for a frugal lifestyle that demands sacrificing things you enjoy. Instead, Sethi’s philosophy is about mindful spending: cutting costs on things that aren’t important to you so that you can invest in experiences and items that bring you joy.

“I Will Teach You to Be Rich” is more than just a finance book; it’s a manual for creating a lifestyle that balances financial success with personal happiness. Sethi’s philosophy underscores the idea that financial literacy isn’t about deprivation, but about making informed decisions that allow us to live richer lives, both financially and personally.

This post may contain affiliate links, meaning we may earn a commission if you make a purchase through these links, at no extra cost to you. We recommend these products because we genuinely believe they could be beneficial to you. Learn More!

“Total Money Makeover” by Dave Ramsey

Dave Ramsey’s “The Total Money Makeover” is a straightforward guide for those seeking to conquer debt and achieve financial peace. Ramsey presents a step-by-step plan to accumulate wealth, which requires plenty discipline and determination, but promises substantial rewards.

Ramsey’s outlook on debt is unambiguous: he hates it, particularly consumer debt. He argues against the common use of credit cards, believing that their potential harm far outweighs their benefits. Ramsey’s advice: cut up your credit cards. His rationale? They can easily lead to financial habits that land you in debt, derailing your financial peace.

His philosophy is grounded in reality. Ramsey advocates for a realistic approach to managing your money, urging you to be honest with yourself about what you can and can’t afford. Overspending and living beyond one’s means are two pitfalls he urges his readers to avoid.

Ramsey’s well-known mantra, “live like no one else, so later you can live like no one else,” perfectly captures the essence of his approach. This calls for short-term sacrifices and disciplined living to pay off debts in order to be able to save and invest. The end goal is a life free from financial worry, where you enjoy the fruits of your sacrifices and disciplined living.

“The Total Money Makeover” is about your journey towards reshaping financial habits, fostering disciplined living, and ultimately, achieving financial peace.

This post may contain affiliate links, meaning we may earn a commission if you make a purchase through these links, at no extra cost to you. We recommend these products because we genuinely believe they could be beneficial to you. Learn More!

Conclusion

Reading “Rich Dad Poor Dad”, “I Will Teach You to Be Rich”, and “The Total Money Makeover” can be a transformative experience. Each book offers a unique perspective, yet all three converge on one common goal: changing your perception of money and fostering financial literacy.

These books are not just repetitive ideas of financial knowledge; they’re guideposts for practical application. They encourage you to think differently, to challenge conventional notions about money, and to adopt a proactive approach towards your financial health. By integrating the tips and strategies these authors have shared, you can navigate the path to financial stability more confidently.

Reading these books is only the first step. The real transformation begins when you start applying these lessons in your daily life. Each book underscores the importance of acting now – it’s never too late to start working towards financial freedom.

The journey towards financial literacy is a continuous learning process. With these books as your guide, you can move towards understanding your finances better, start making informed decisions, and ultimately, securing your financial peace.

Remember, the most important step in this journey is the first one. So, start today. Your journey towards financial freedom and peace awaits.

Join the Conversation and Take Charge of Your Financial Future

Have you been inspired to delve deeper into your financial journey? Maybe you’ve read other enlightening finance books that aren’t on this list? We’d love to hear from you. Knowledge is most beneficial when shared, and your recommendation could become the key that unlocks financial freedom for someone else.

Don’t hesitate to reach out and share your favorite financial books with us. Together, we can empower each other to make informed financial decisions and strive for financial peace.

So, take charge today. Start with these top finance books or share your own recommendations. Your journey towards financial literacy and freedom starts now!

Pingback: Beginner's Guide to Investing: What to Know (2023) - SmootherFinance